In the world of finance, few concepts wield as much influence and potential as compound growth, and in order to benefit from compound growth you have to stay invested.

It can feel uncomfortable at times and that is where having a financial planner comes into its own. They will create a robust, long-term financial plan for you and equally as important, provide guidance, leadership, and reassurance during times of market stress.

The concept of staying invested is logical and proven over the long term, however, your convictions will be tested during your investment journey.

Think about the recent past. The global markets in 2022 were, for the first nine months, in a downward trend, but recovered in the last quarter.

If you were tempted to disinvest, you would have missed the recovery. The same principle applied in 2020 during the pandemic, in the summer of 2015 when concerns over China’s economy dominated the narrative, and most significantly the global financial crisis that began in 2007.

Impact of compounding

The importance of staying invested cannot be understated, as it is this positive action that allows the concept of compound growth to work in your favour. It would be great if there was a shortcut to long-term investing, but that simply is not the case.

Successful long-term investing comes from patience and consistency. Investing early and regularly, taking sufficient risk to profit from opportunities and grow your wealth significantly over time.

Compounding is great. If you follow the path you can benefit from the return on your returns.

The initial phase feels slow, but the best example of this stealth-like compounding can be illustrated by the famous story of a grain of rice and a chessboard.

There are 64 individual squares on a chessboard and if you place a grain of rice on the first square and then double it for each subsequent square, you can see the importance of compounding, but equally the importance of staying the course.

After eight squares have been filled, you are only up to 128 grains of rice on that eighth square and 255 grains of rice in total. However, the next eight squares see the total ramp up significantly: 32,768 grains on square 16, and a total of 65,535 grains in total.

The final square would have 9 quintillion grains on it and the total number of grains in excess of 18 quintillion. A quintillion has 18 zeros after the number; it is a huge number.

Where to invest?

The key question is where to invest to take advantage of long-term investing, compound growth, and staying the course.

The two examples we are going to look at are Individual Savings Accounts (ISAs) and Personal Pensions. Both have important tax advantages, with limits on how much you can invest, and the results of steady and consistent saving are very interesting.

Individual Savings Account

For maximum flexibility with your investments, the Individual Savings Account (ISA) is a great product for investing, as any growth is exempt from both Income Tax and Capital Gains Tax.

There are limits as to how much you can invest in any single tax year, and if you do not take advantage, then the allowance is lost. There are several different versions of ISAs and for the purpose of this article, we are focusing on the Stocks & Shares ISA, which allows investment into a wide range of vehicles.

ISAs were first introduced on 6th April 1999, meaning there have been 26 tax years in which you could have invested up to your allowance. The initial allowance in the tax year 1999/00 was £7,000 and has increased to the current allowance of £20,000.

If you had taken advantage of the ISA allowances from 1999 until the end of the 2024/25 tax year, you would have invested a total of £326,560. If we assume an annualised rate of return of 6%, this would have grown to £654,452.

There are investors who have accrued portfolios in ISAs with values in excess of £1,000,000. Being an ISA millionaire is not as outlandish as it sounds.

It can come down to the level of risk that you are willing to take and how early you get started. Generally, the higher the risk the higher the potential return on your investment in the long term.

Changing the assumed annualised rate of return in the above example to 9.2%, would have delivered a final value of £1,000,000. Alternatively, assuming the current annual allowance remains at £20,000 and the assumed rate of return remains at 6%, the ISA will be worth more than £1,000,000 in 2031.

This illustrates the power of compounding, as in this example you will have only invested a further £120,000 (six more annual allowances), yet the value will have increased by over £420,000.

Those early years will have had over a quarter of a decade to grow, and this is where the power of compounding really comes into its own. While ISAs are accessible whenever you need the money, there is another tax-efficient savings plan where the money is locked, currently, until your 57th birthday.

This avoids the temptation of chipping away at your savings and the government will also contribute on your behalf too.

If you begin saving early enough it also allows the investment to grow over a considerable amount of time and, with robust investment planning, could provide a valuable source of income in retirement. This product is a pension.

Pensions

Making use of the current tax allowances is a great way to start that investment journey and you can never be too young to start. Pensions are a core savings and investment vehicle for many in the UK with 6.8 million people making contributions to a personal pension plan in the tax-year 2022/231.

Those contributions will have attracted tax relief, one of the key features that make pensions attractive to individuals, totalling £48.7 billion in the tax year 2022/231.

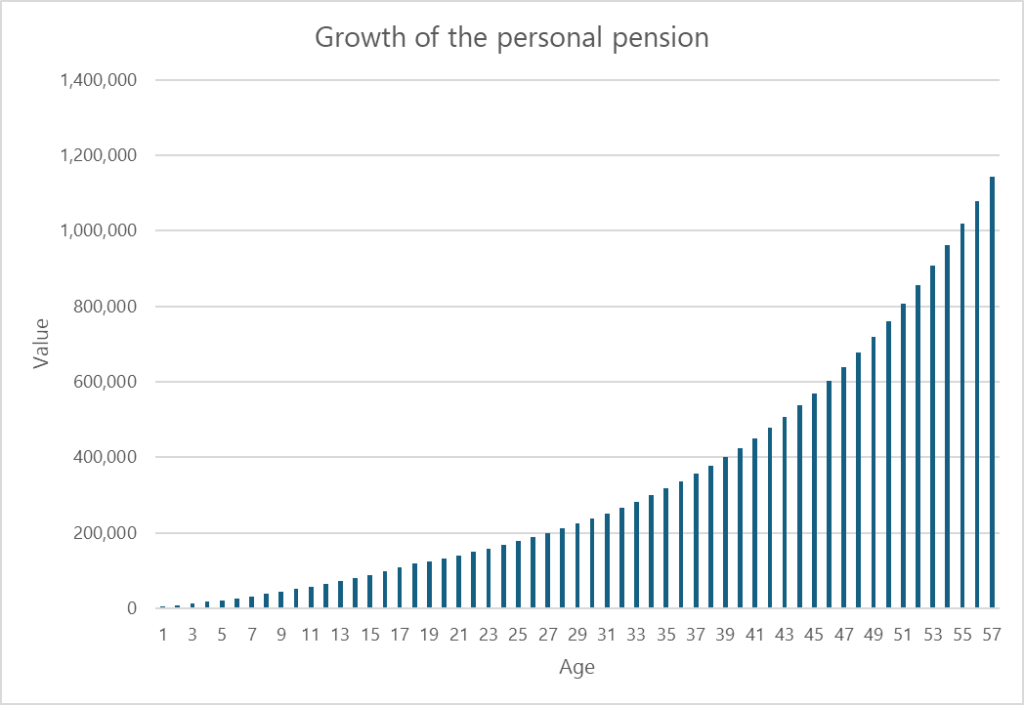

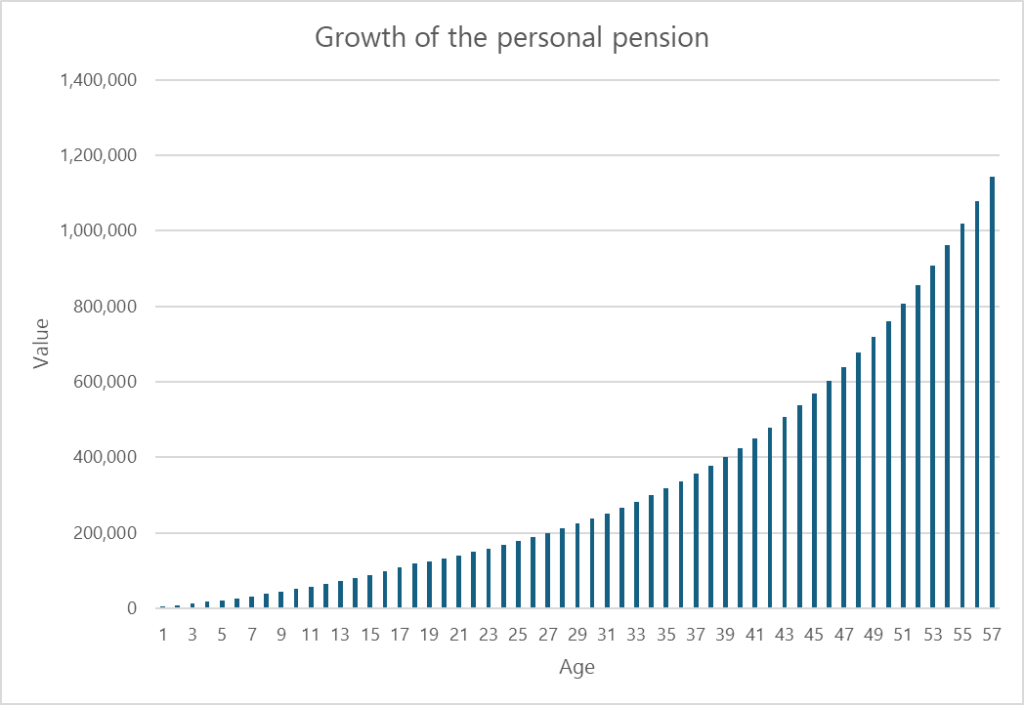

You can start paying into a pension plan the day you are born. The current legislation allows an annual contribution of £3,600 to be paid into a Junior Self Investment Personal Pension (SIPP).

The government will provide 20% tax relief on this contribution, meaning the net cost of the payment is £2,880. This allows parents, grandparents, and friends to contribute to a Junior SIPP and give that child a significant head start in their pension journey.

If we assume that the maximum allowance of £3,600 is paid into a Junior SIPP from birth until their 18th birthday; the child will have had £64,800 contributed to their plan, but it will have only cost the contributors £51,840 because of tax relief.

With the contributions alone that amount paid in is more than the average pension pot for someone aged 36-442. However, if those contributions had been invested in an appropriately diversified portfolio, the actual value of their pension pot could be considerably higher.

Assuming an annual net return of 6% per annum, the Junior SIPP could be worth £117,936 on their 18th birthday. That is more than double the net amount contributed on their behalf and higher than the average pension pot for someone age over 652.

The story does not end here, it only gets more interesting.

The child is now an adult at 18, and the Junior SIPP becomes a fully-fledged Personal Pension (PP) and they can now take control of the plan, investment strategy and any contributions they want to make (subject to the annual allowance and their earnings).

This is where the power of compounding comes in. Those first 18 years of contributions have another 39 years of growth, so the child may not actually have to make any contributions themselves.

From age 18 onwards, the value of £117,986 will continue to be invested and continue to grow at the assumed net return of 6% per annum.

Even without making any further contributions to the plan, as you have already given them the head start the value at age 57, when they could access their personal pension (assuming current rules), will be £1,144,393.

Currently, you can take up to 25% of your pension plan value as a tax-free lump sum, up to a maximum of £268,275. So, the final value at age 57 is just over this.

This shows the power of compounding and the possibility of providing your child with financial freedom when they reach their 18th birthday. Plus, the government will help pay towards it too.

Conclusion

There is a Chinese proverb that says “The best time to plant a tree was 20 years ago. The second best time is now.” If you are currently invested, then stay invested. If you are not invested, then start now, and begin your journey to securing your best financial life.

Talk to your financial planner in starting this journey and keep regular updates with them to help you stay invested and enjoy the benefits of compound growth.

Key takeaways

- The sooner you start investing, the longer the effect of compounding will have on your savings – it is never too soon to start

- Utilise the annual allowance for ISAs and let your savings grow Income Tax and Capital Gains Tax free, while retaining immediate access

- Give your child financial pension freedom by paying into a pension plan from when their birth until they reach age 18, and they may never have to contribute themselves

- Stay invested – over the long term those who stay invested capture both the ups and downs of the markets, but in doing so put the odds in their favour, as the ups outweigh the downs

The examples provided are for illustration purposes only and assumed rates of return are not guaranteed.

Tax rules could change in the future and tax benefits depend on your personal circumstances. All information included here is correct as of the date of posting.

Values are not guaranteed and can go up or down.

Sources:

1www.gov.uk – Private pension statistics commentary: July 2024.

2www.nutsaboutmoney.com, Office for National Statistics, January 2025.